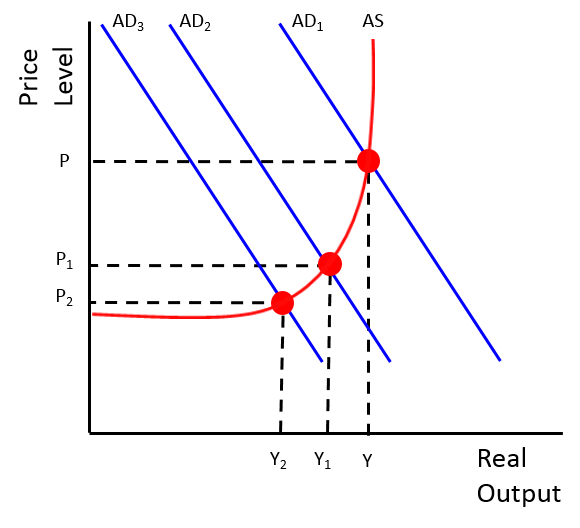

Economic policy decisions that aim to restructure the economy so that is is possible to achieve economic growth as well as reduce the budget deficit and ultimately create a budget surplus so that national debts can be repaid. In order to achieve this the policies will involve increasing taxes (increased leakage) or reducing government spending (reduced injection). The net result of this will be an inward shift in AD (AD1 to AD2 )and downward pressure on real national output (Y to Y1) and the price level (P to P1).

If these policies contribute to a loss in confidence then it is likely that there will be a further fall in AD (AD2 to AD3). if the downturn is sustained in the long run some economists have argued that if the downturn is sustained over a long period tit will also lead to a damaging contraction in AS.

It is important to understand that contraction is only part of the Austerity story. The point of experiencing the resulting contractionary effects of Austerity policies is that the negative short term impacts will be offset by a recovery in the medium and long term. This is expected to arise from avoiding any credit rating downgrades by being seen to proactively manage national debts, pursuing expansionary monetary policy and structuring the changes in taxes and spending to rebalance the economy so that the public sector contraction is covered by an expansion fo the private sector.

Managing the cost of debt is critical in the UK due to the high levels of government, personal and corporate debt. Any reduction in the UK's credit rating will feed into financial markets and drive up the cost of borrowing.

Needless to say this debate is heavily politicised and it is important that students are able to present a balanced view of this policy.