Is an elasticity measure that is used in economics to identify the responsiveness of quantity demanded to changes in price. These measures can become very useful evaluative tools when structuring an exam answer to a data response question. This is because the impact of demand and supply curve shifts on the market equilibrium will depend on the position and slope of these demand curves and that is determined by the elasticity values of the good.

When referring to elasticity measures that relate to demand, there are three that will aid the evaluation of an exam answer:

PED = Price Elasticity of Demand

YED = Income Elasticity of Demand

XED = Cross Elasticity of Demand

Out of these elasticity measures PED provides the most intuitive analysis when evaluating the demand curve of a particular good. Using PED as an elasticity measure we can define a good's demand as:

Inelastic Demand

Elastic Demand

Unitary Elastic Demand

Perfectly Inelastic Demand

Perfectly Elastic Demand

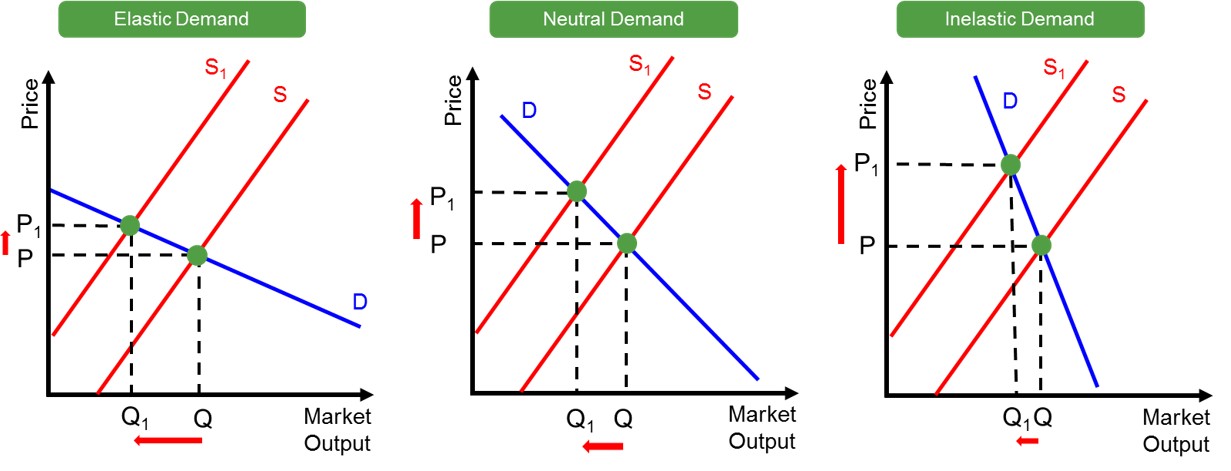

PED is a useful and effective concept when evaluating supply curve shifts, as the impact on the price and quantity demanded will depend on the elasticity of the demand curve for a good. For instance, if a demand curve is inelastic then when there is a supply curve shift it exacerbates the impact on price, but the impact on quantity is muted. This is because the inelastic demand curve relates to goods in which consumers are not price sensitive, despite the magnitude of the price change. This is often the case in markets which provide goods which are necessities to consume, such as agricultural products. Below is an example of how the elasticity of the demand curve in a market impacts changes in the market equilibrium:

In this case, there is an inwards supply curve shift and this creates pressure for prices to increase to P1 as a result of excess demand. This is the case regardless of the elasticity of the demand curve. However, as is shown in the diagrams, the more inelastic the demand curve the greater the price increase in the market. The opposite process would occur if the supply curve would outwardly shift.

This demonstrates that elasticity is a powerful evaluative tool when analysing changes in demand/supply curves and forms a crucial part in describing the chain of economic events that unfold in these types of markets.