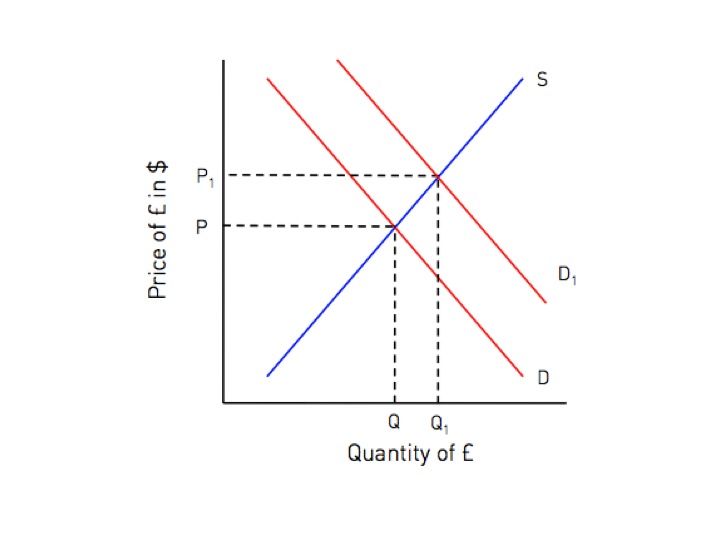

A rise in the value of a currency due to excess demand for the currency. This will result in higher export prices and lower import prices.

In this example an increase in exports has increased the demand for the currency from D to D1. Without any change in supply to accommodate this demand this means the excess demand increases the exchange rate (the price of the currency) fro P to P1. At a price of P1 the exchange rate has appreciated and the movement up the supply curve means that the equilibrium is re-established as D1 = S.

Foreign currency is possibly the best example of how the forces of demand and supply operate, as vast amounts of currnecy are traded around the clock. Market makers will continuously adjust currency rates (the price of a currency) to clear the market by balancing prospective buyers and sellers. If there are more prospective buyers than sellers this means the price is too low and market makers will respond by gradually raising the price. The respective laws of demand and supply means that this price rise will disincentivise demand and incentivise supply until the market finally clears when the price reaches the point where demand equals supply. This is how exchange rates appreciate.

An appreciation in exchange rate can be caused by:

- An increase in demand - because foreign countries require sterling because they wish to acquire UK goods and services or they wish to move their savings to the UK.

- A reduction in supply - because UK firms and individuals supply sterling to acquire foreign currency so they can purchase imports or to move their savings to other countries.