This is where the outcomes for firms depend not only on their own decisions but also upon other firms' decisions. Oligopoly markets are the type of market structure that is characterised by a high level of interdependency as firms always have to take into account the reaction of rival firms when setting their own prices.

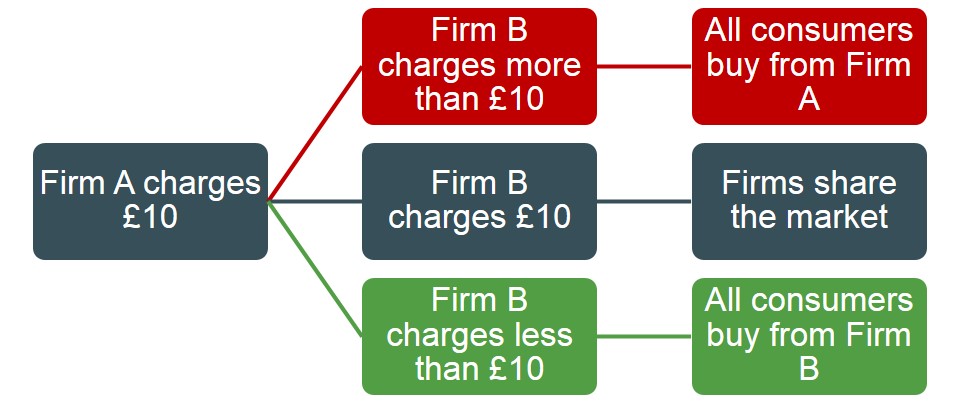

Below is an illustration of how interdependency works. For instance Firm A sets a unit price of £10 but the market outcome of that pricing decision depends on the type of reaction that Firm B takes. The flowchart shows that Firm B could react in three ways. Firstly they could end up charging more than £10 which means that Firm A will have undercut Firm B and steal the entire market for themselves (assuming competing over a homogeneous good). Firm B could also match the price of £10 and both firms would roughly share the market between themselves. Finally, Firm B could also decide to undercut Firm A and charge a price lower than £10 and as a result they would capture the entire market. Therefore, before Firm A sets their price they have to form a rational expectation of what other firms in the market will do, to be able to set their profit-maximising price.