Goods that are used in the production of other goods and services e.g. machinery, computers, vehicles. They will create more value than consumer good and contribute to economic growth.

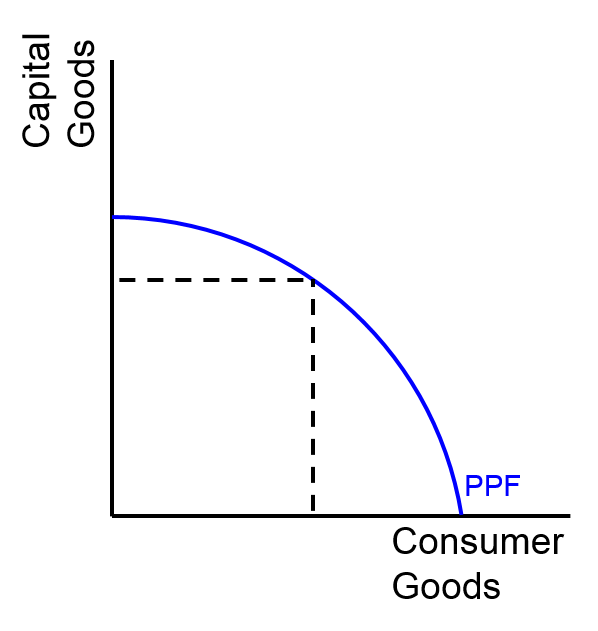

The diagram below shows an economy that is positioned to produce either capital goods or consumer goods and because capital goods have a bigger influence on economic growth, this economy is slanted towards producing more capital goods compared to consumer goods. But, it is still positioned on the PPF and therefore is fully utilising all the resources available in the economy.