Is a term that applies to individuals that are of working age, but currently do not have a job and have been actively seeking employment.

In most cases, unemployed people are individuals who are willing and available to work but often cannot find a job that matches their preferences. If an individual is unemployed they still make up part of the labour force as they are likely to continue to contribute towards the economy for most of their working life.

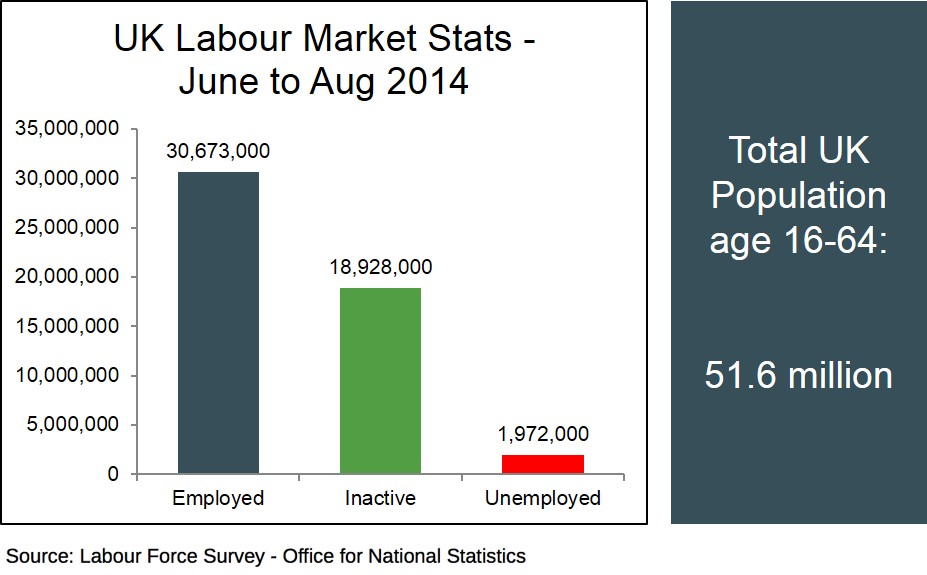

In the UK, the official measures of unemployment and employment is measured using the Labour Force Survey - which is a household survey of the current employment positions of agents.

Below is a breakdown of the amount of workers who were classed as employed, unemployed or outside the labour force and economically inactive in the UK from June to August 2014. This measurement is taken using the government's Labour Force Survey.

There are many different forms of unemployment in an economy:

- Cyclical unemployment

- Structural unemployment

- Frictional unemployment

- Seasonal unemployment

- Real wage unemployment (Classical unemployment)

Unemployment is used as an indicator to judge how strong and robust an economy is and if the unemployment rate is close to the natural rate of unemployment then this is a sign the economy is close to full employment and as a result any further expansions in the economy in the short run will introduce inflationary pressures in the economy. This is why Central Banks of a country always use unemployment data when making their decision on interest rate changes in the economy.

Low unemployment is an economic aspect that all governments aspire to achieve because it creates a high level of confidence in the economy which can spur on economic growth and investment. It can also improve the budget position of the government by improving the inflow of tax revenue whilst simultaneously reducing the level of benefits required to be paid out. Low unemployment also satisfies one of the main macroeconomic objectives for the government but it could simultaneously create a conflict with other objectives. The most notable one is the trade-off between unemployment and inflation that is displayed in the Phillips Curve. It can also create problems on the current account position of a country as higher consumption fueled by greater confidence can increase consumption of imports.

It is important to note that unemployment is not always as negative for an economy as it seems. For instance, a high level of unemployment increases the pool of available workers for firms to employ and this creates the potential for these firms to expand, adding to the productive capacity of the economy. Also with persistent unemployment some workers may become disillusioned with the labour market and decide to go down the self-employment route and by doing so could increase entrepreneurial innovation and activity in the economy, which is beneficial for an economy.

Another evaluation point to consider regarding unemployment is that if we have a situation where output falls, it does not always feed into higher levels of unemployment because of important time lags between the economic cycle and the unemployment cycle i.e. firms will postpone laying off workers until they are sure that an economic downturn is likely to be sustained. In some cases firms may even engage in labour hoarding - where they keep their workers on the payroll during an economic downturn, ready to re-employ when the economy recovers.