The process by which central banks create new money to buy sovereign debt and other financial assets. This aims to stimulate economic growth by increasing credit available to individuals and firms, reducing the cost of new and existing borrowing and produce various wealth effects by increasing the value of financial assets.

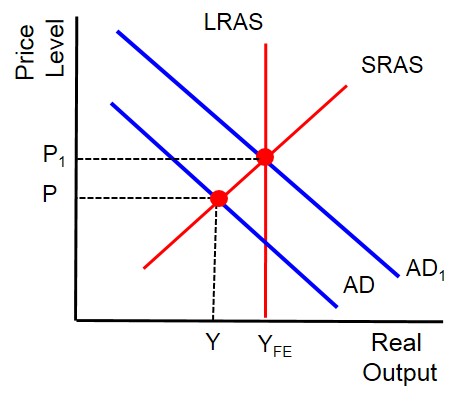

Below highlights the theoretical impact of QE into an economy with deficient aggregate demand. The purchasing of bonds makes credit cheaper and easier for business, individuals and households to acquire and therefore increases the amount of economic activity through business expansions and and house purchases. Ultimately, this contributes to a higher level of aggregate demand and despite introducing some inflationary pressures this is just moving the economy back to the full employment level.