Describes a situation where a group of countries adopt and share a common currency between them.

A currency union is often established to help an economic and political union function more effectively. This is because if all countries within the union share the same currency it makes it easier for common economic policies to be introduced and implemented across all union countries and therefore theoretically creates stable and certain economic conditions across all member states.

The easiest way tot understand the fundamentals behind how a currency union operates and the impact it has on member states, is to look at a real world example. The greatest example of this type of union is the Eurozone. This is a currency union made up of 19 countries from the European Union, that have replaced their own national currencies with the Euro. This monetary union was established in 1999 and the common currency (euro) is controlled by the common central bank (European Central Bank). The Eurozone is open to any country that can fulfill the convergence criteria i.e. membership is successful if countries can provide evidence they will not introduce unwanted destabilising effects into the union. This convergence criteria focuses on the countries performance regarded the main macroeconomic objectives (e.g. inflation, government finances). The main characteristics of this type of union are:

- Common Currency - All countries must replace their own national currencies with the single currency, the euro.

- Common Central Bank - A single independent central bank must be in charge of setting the monetary policy instruments for the entire currency union i.e. interest rates. For the Eurozone, this central bank is called the ECB (European Central Bank) and is an independent body responsible for the distribution of notes and coins of euros across the Eurozone, deciding on the interest rates for members in light of achieving an inflation target, maintaining stability in the financial system and markets and holding foreign currency reserves to intervene in the the foreign exchange market to affect the value of the euro against other currencies.

- Stability and Growth Pact - All countries must ensure that government borrowing is limited to just 3 per cent of GDP, to ensure fiscal stability is maintained across the region.

Countries decide to enter a currency union on the basis that it helps a country achieve greater certainty and stability within their own respective economies. This stability helps foster other advantages, such as:

- Exchange Rate risks and costs are eliminated - Exchange rate fluctuations between union countries that used to exist will now no longer exist because of the fact that all countries have adopted the same currency. This means uncertainty regarding the value of national currencies have been removed and this encourages countries to engage in more intra-union trade and investment as a result of the reduction in uncertainty.

- Transaction costs reduced - As all countries are using the same currency, countries no longer need to pay for the transaction costs of converting their own national currency into a foreign currency when importing goods from other countries inside the union. This benefits all firms operating in countries within the currency union and will boost the real output (GDP) for a country.

- Easier price comparisons - When countries use a single currency it makes price comparisons easier across the union, as consumers do not have to account for differences in the values of national currencies. Therefore, from the consumer's perspective it makes it easier for them to obtain the information that is necessary for them to buy the good for the cheapest possible price. From the firms perspective it means firms cannot get away with charging different prices to different countries as they will be exposed by the single currency. This advantage could mean that prices remain stable and equalise across the union and this is a boost for consumers.

- Economies of Scale - The increased certainty and stability that comes from the elimination of exchange rate risks and costs means that firms are more likely to engage in large scale production to sell goods to the entire union, rather than individual countries and this is likely to yield lower prices for consumers.

- Increased FDI - Countries operating in the rest of the world have a greater incentive to invest in countries inside the Eurozone because it allows firms from the rest of the world to sell goods to European countries without any euro exchange rate fluctuations. This points to why FDI in the UK has been falling over time as global firms do not want to be subject to exchange rate fluctuations regarding the pound and the euro.

However as large as the benefits of becoming a member of a currency union are perceived to be there are also some significant costs attached to adopting a single currency as well. The costs are as follows:

- Conversion Costs - When countries switch from their own national currency to a single currency there are currency conversion costs that have to be incurred when converting all the coins and notes in circulation currently. This is a process which can take time and cause consumers slight problems in terms of adopting to new currency and pricing system.

- Loss of Monetary Policy Autonomy - When a country becomes part of a currency union they had to sacrifice their own national monetary policy independence as the common central bank is in charge of setting interest rates and the money supply. This is problematic for union countries as they no longer have the ability to influence their own domestic economy via setting their own interest rates and own monetary policy. Which means policymakers are restricted when it comes to combating and responding to economic shocks as interest rates can no longer be influenced to affect the inflation, unemployment and growth rate. However, the loss of monetary policy independence is only an issue if countries within the union are asymmetric i.e. their business cycles are not aligned. This is because the one size fits all monetary policy set by the ECB works effectively if all countries business cycles move symmetrically. As the interest rate that needs to be set to help all countries achieve macroeconomic stability will be at the same level. However, if some countries experience a recession and other countries experience a boom, it is very difficult for the ECB to set an interest rate that is optimal for all countries.

- Lack of Fiscal Union - To achieve political and economic stability across the union there not only needs to be macroeconomic stability but also fiscal stability as well. Because a currency union like the Eurozone does not have a fiscal union in place it makes it very difficult to incentivise all countries to become fiscally responsible. The stability and Growth Pact which was created to ensure that fiscal stability was created is often breached by countries that are facing a recession.

- Lack of independency - The ECB is meant to be an independent body that sets the interest rate for the Eurozone but often the ECB sets the interest rate that is appropriate to the most powerful countries within the Eurozone such as Germany and France. This perhaps explains why these are the best performing countries within the euro.

- Loss of Sovereignty - The fact that the decision of the implementation of national policies are being passed onto foreign institutions such as the ECB means there is a loss of national sovereignty for certain countries since the control of monetary and exchange rate policy are no longer in countries hands.

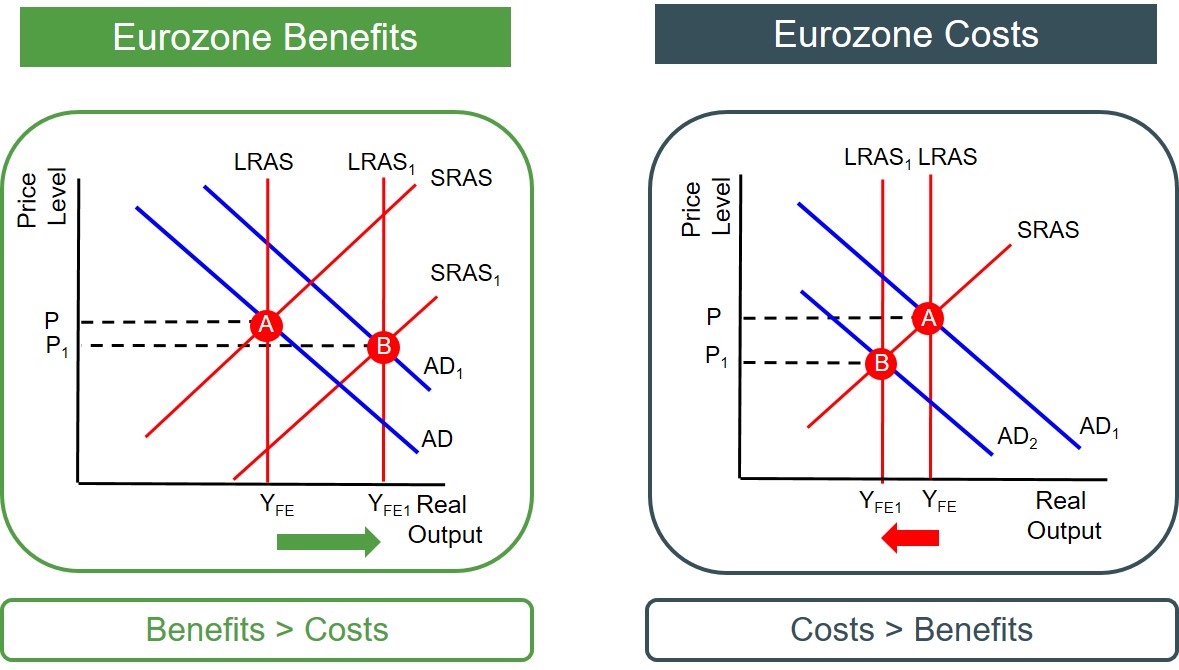

When a country joins a single currency like the Euro it can exist in either two states. The net effect is that advantages exceed the disadvantages and there is a positive impact on Aggregate Demand and the LRAS curve as a result of increased intra-union trade and investment. Therefore dis inflationary growth is achieved. This is what is seen in the strongest Eurozone economies such as Germany. However, it may well be a country is in a position where the disadvantages exceed the advantages and this causes demand to stagnate and growth to fall, as the AD and LRAS curves shift inwards. This is seen in struggling Eurozone countries like Greece. The states are illustrated below.

The key question when analysing a currency union like the Eurozone is determining whether becoming a member of this type of union is beneficial or costly for a particular country. But it almost impossible theoretically to say whether a country joining a single currency will be made better-off or worse-off. As each country is in a different position in terms of trading patterns and exposed to different types of economic shocks. Therefore, in an exam situation when evaluating the decision of a country to join a single currency, the focus should be on what economic conditions need to satisfied for membership of a single currency to be optimal and what conditions need to be present for membership to be a disaster for a country.

Therefore countries like the UK use a series of tests to assess whether becoming a member of a single currency like the Euro will introduce net benefits or net costs. In 1997, Gordon Brown introduced a series of tests which would have to be met and passed if the UK would find it beneficial to drop the Pound in exchange for the Euro. The five tests concerned : compatibaility, ability to manage financial problems, attraction of investment into the UK, level of benefits passed onto banks and the ability to create sustainable growth. Since 1997, the UK has never been able to meet all of the criteria and therefore have found it beneficial to maintain their own national currency. From the UK's perspective the view is that UK continues to use the pound sterling because the benefits brought about by remaining to use their own national currency is a critical success factor behind the economic growth rate of the UK.