A situation where a good is demanded for a variety of different reasons e.g. timber is demanded to make houses, furniture, paper and many other purposes.

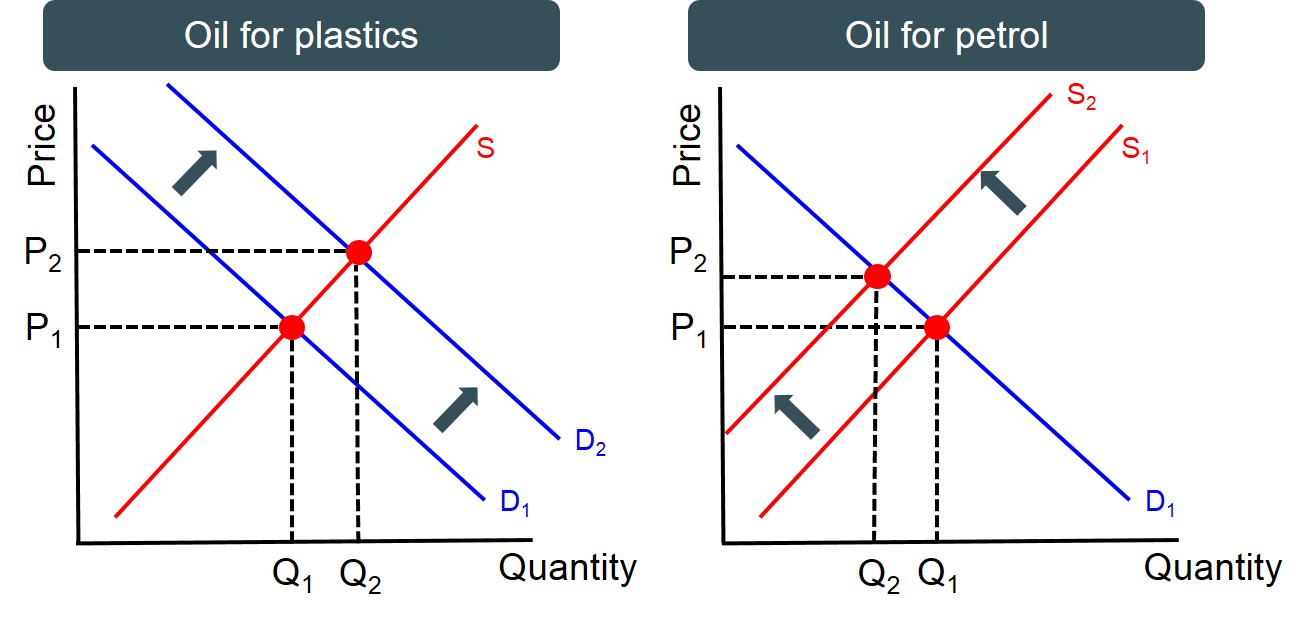

Below is a diagram to illustrate composite demand for a product that has many uses in alternative markets, oil. In the diagrams below an increase in demand for oil from plastic producing firms, has to result in a fall in the supply of oil in the petrol market as oil is a composite product has lots of alternative uses. This logic could be applied to other products such as bread and steel.