A persistent rise in the price level within an economy over a period of time. As a result this causes the value of money in the economy to fall, as each unit of currency now buys fewer goods and services.

It is important to note that inflation in a country can be either rising or falling. But as long as the inflation rate remains positive, it can still be classed as inflation as overall the price level is still rising from one period to the next, but crucially not as significantly as the previous period. Falling inflation is called stagflation. Whilst a negative inflation rate is classed as deflation because the general price level falls from one period to the next with a negative rate.

A country's inflation rate is calculated by using a weighted price index (e.g. UK Consumer Price Index) that measures the changes in prices of the everyday goods and services that the average household consumes. It is a weighted index as greater weights are attached to the most popular goods, as price changes in these types of goods will impact households more than luxury items. The inflation rate is then measured by calculating the percentage in this weighted index from one period to the next.

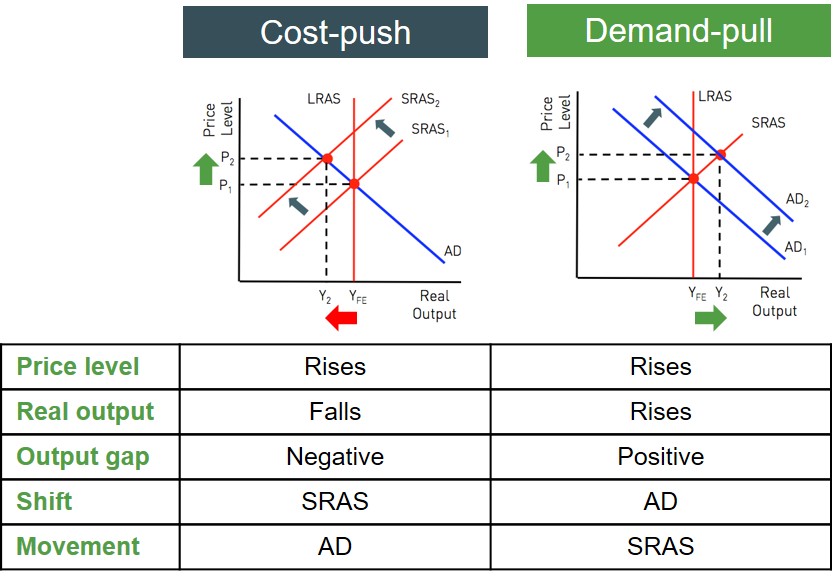

Inflation in an economy can either be classed as demand pull inflation or cost push inflation. Below is a summary of the AD-AS impact of these two types of inflation.

Both of these types of inflation push the price level up as a result of a macroeconomic disequilibrium and this in turn creates an output gap. Therefore in an exam question it is important to evaluate what is the cause of inflation in an economy and from that you can assess how large an impact this factor has had on the inflation rate i.e. has it caused the inflation rate to increase rapidly or insignificantly. This is important as from this initial evaluation point you can argue and discuss the possible economic policies that may be implemented in response to the inflation rate rising too quickly, in order to protect a country's competitiveness.

Inflation is predominantly used as an indicator about the overall strength and health of an economy as it highlights that the confidence amongst consumers and businesses is high and the labour market is in a strong and robust position. However, if inflation becomes too high then it can create uncertainty and can potentially destabilise the whole economy as money loses its value very quickly. This is known as hyperinflation and is a common problem in developing countries that run infeasible economic policies. As a result, most countries use an inflation target to keep the inflation rate within a narrow range of values. This inflation target is set at a moderate level with higher and lower bounds to ensure macroeconomic stability is in tact. In the UK the Bank of England set a CPI inflation target of 2%.

Inflation can be good and bad for an economy. Some of the benefits are: It can increase confidence and spending, reduce the value of borrower's debt burden, increase business production and reduce real wage costs for businesses. But despite those benefits it can be argued that inflation can be damaging to an economy as it creates uncertainty, lowers capital accumulation, increases menu costs and negatively impacts savers/lenders.

Overall, inflation is a very important discussion point in an exam as the level of inflation in an economy changes when the AD or SRAS curves shift. You will then be required to evaluate the extent of the inflation change by looking at factors such as:

- The size and significance of the curve shifts

- The sustainability of the shifts (short run and long run impact)

- The level of spare capacity in the economy

- The level of volatility of the inflation rate (the likelihood of creating uncertainty)