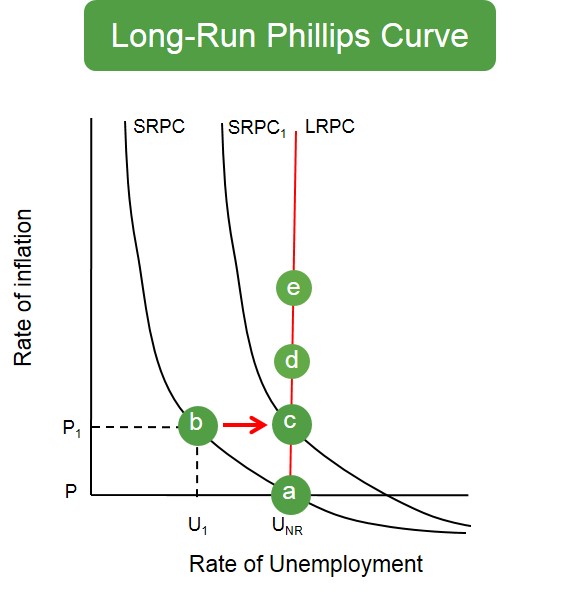

This curve is a straight vertical curve and shows that no matter the rate of inflation, in the long-run the rate of unemployment is consistently the same. In other words, in the long-run there is no trade-off between inflation and unemployment

Below is a diagram to show how the long-run version of the Phillips curve is formed. An expansion in AD creates economic growth and reduces unemployment below the natural rate of unemployment and this moves the economy to point B as jobs are created in the short-term. However workers now have more bargaining power, workers demand higher wages and this forces production costs up to a new higher level for firms, these then eventually get passed on as higher prices. Eventually in real terms nothing changes as the economy ends up at the natural rate of unemployment but just with a higher level of inflation. This is shown by the upwards shift of the short-run Phillips curve. This process continues to repeat itself with the only substantial effects being inflationary effects. Therefore the LRPC is derived from the continual shift up in the SRPC due to economic agents rational expectations.