Costs arising from the production of a good or service that are imposed onto third parties e.g. the pollution associated with oil extraction.

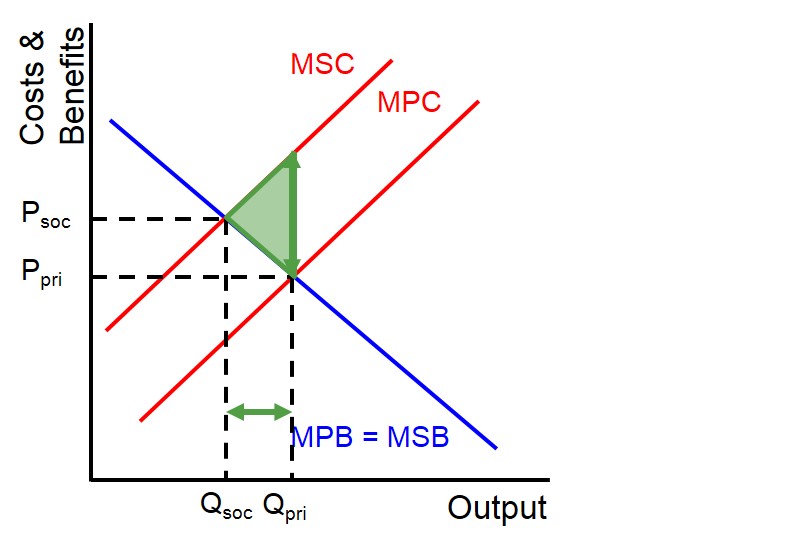

Below is a diagram to show a negative production externality that is being imposed on third parties. This is created because of a divergence between the marginal private cost and marginal social cost curves i.e. individual producers do not realise the negative externality they are releasing onto society and therefore they over-produce the good. This leads to the level of output produced to be above the socially optimal level and ultimately this leads to market failure. The deadweight loss triangle represents the size of the externality in the market.

When evaluating policies that governments could implement on the market to correct this type of market failure, it is important to consider the size of the externality. The larger the externality in the market, the more incentive there will be for governments to intervene in the market, as the larger externality the greater the impact on society's welfare. However, for governments to correct the market failure, they need to calculate how large the production externality may be. It is almost impossible for governments to accurately quantify the size of the externality in the market and therefore this means government intervention can be an imperfect measure to internalise the externality and as a result government failure could arise.