The position of the demand curve moves due to a change in one of the determinants of demand. Shifts can be positive (to the right) or negative (to the left). If demand shifts there is an equal change in demand at every price level.

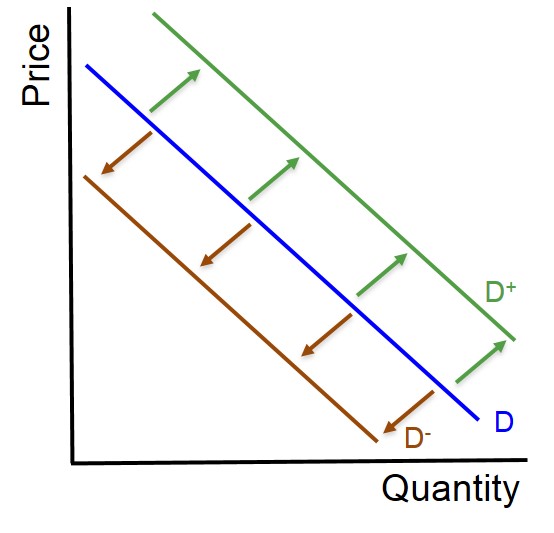

Below is a diagram to show the two types of shift that can occur for the demand curve - an outward and inward shift. These shifts can occur because of a variety of different reasons i.e. a change in disposable income will either increase or decrease the amount consumers wish to buy at a specific price.

However, when evaluating a demand curve shift it is important to understand how significance the shift is. This is because some shifts may be small and therefore this will not have a significant impact on the price or quantity in the market. Whilst other demand curve shifts will be large and bring about large changes in the price or quantity in the market.

One of the most influential factors relating to how significantly a demand curve shift impacts the market equilibrium is elasticity. If the demand curve is inelastic, then the demand curve shift will have a reduced impact on the quantity demanded, despite large price changes. However, if the demand curve is more elastic, then the demand curve shift will have a significant impact on quantity demanded, without large changes in prices.