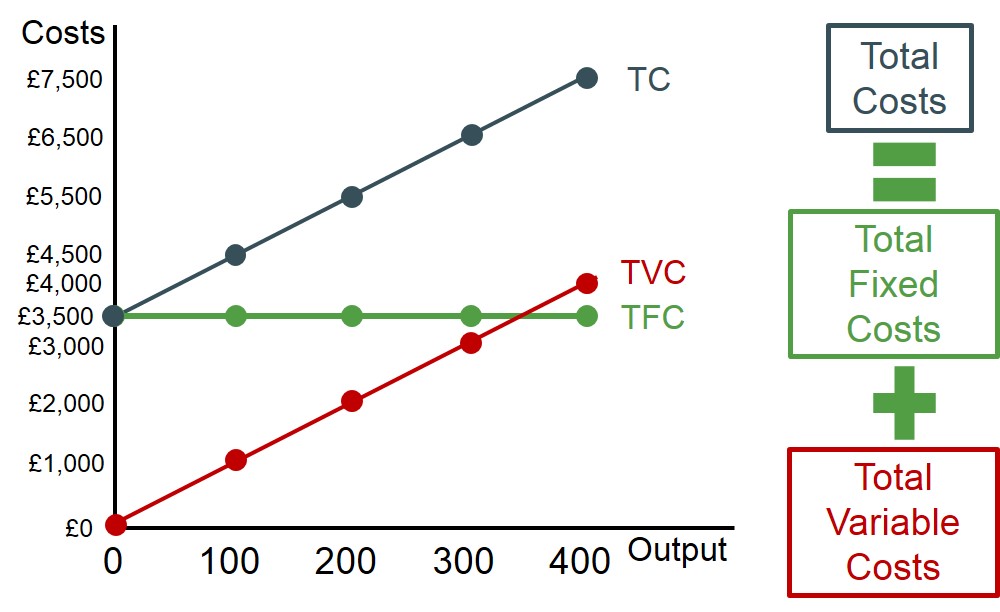

The sum of all costs of production.

Below is a diagram to show that the total cost curve is derived from the total variable cost curve and total fixed cost curve. As these are sepearate costs that face the firm, if at each output level both of these costs are added up the total cost for each level of output can be calculated and by connectng all of these points together the total cost curve can be derived, as shown below.