Trade creation is the term given to the increase in economic welfare that comes from a removal/reduction in trade barriers between countries. The increase in economic welfare is stimulated by a reduction in the price at which goods can be imported into the economy. Lower prices enable consumers to purchase and import more and result in consumption increasing (welfare gain). The efficiency of the market also improves due to inefficient domestic production being replaced, to some degree, by production from the most efficient producers. This improvement in efficiency, in turn, benefits the consumers in a particular market (welfare gain).

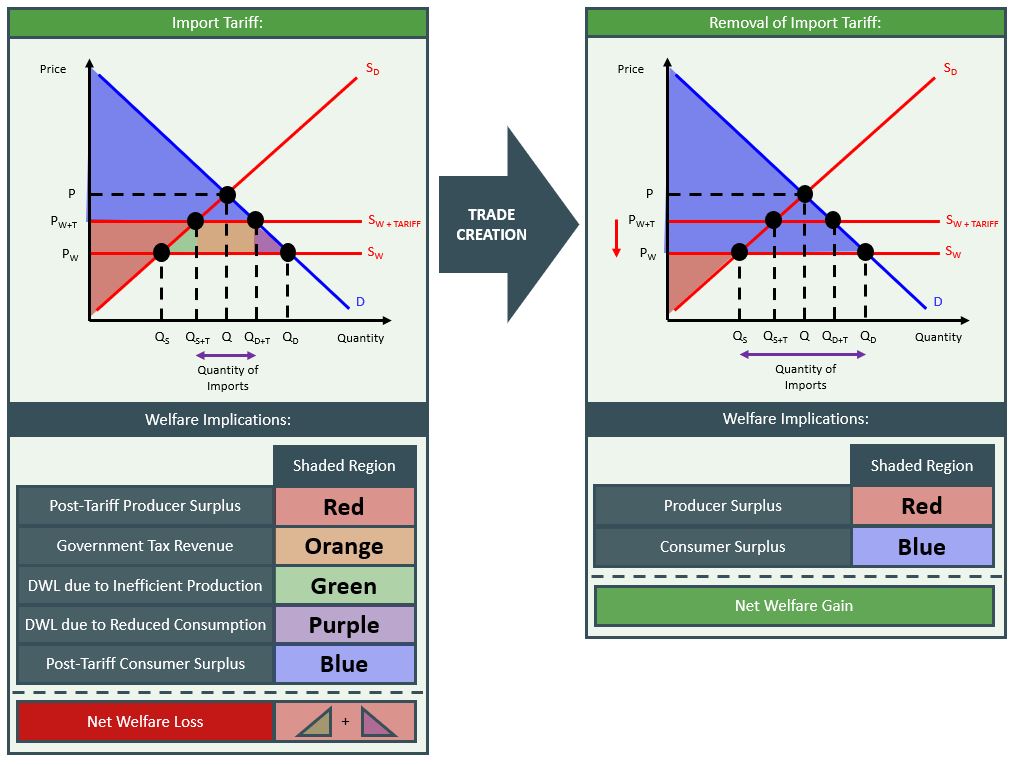

It is important to be able to visualise the impact of trade creation on any particular market which is subject to trade barriers. Below is the market for a particular commodity, with the welfare implications under an import tariff and under free trade (removal of tariff):

The removal of the import tariff forces the world supply curve of the commodity back down to SW and forces the price down to PW. At this price, foreign producers have more influence over the domestic market and more foreign goods are imported by domestic consumers (QD - QS). The welfare implications of this are that the two deadweight loss triangles are eliminated and transferred to consumers via an increase in consumer surplus (due to an increase in quantity demanded and a fall in price). The tax revenue box is also transferred from the government to consumers on the basis of the same logic. This diagram shows how the removal of a trade barrier has resulted in trade being created in the market and has resulted in an improvement in total welfare. This describes the economic rationale behind joining a free trade area such as the European Union.