A good that is under-provided and under-consumed by the market e.g. education, health and museums.

The market failure in these types of goods is caused by a divergence between the marginal private benefit and the marginal social benefit curves. This is because when individuals consume merit goods it releases positive consumption externalities which society benefits from and values but the private individual does not. Therefore, because the individuals are unaware of the higher social benefit, the MPB curve always lies below the MSB curve and this leads to the good being under-consumed in the market e.g. the long run benefits to the economy and economic growth of individuals pursuing higher education.

A merit good is normally under-provided and under-consumed because of three factors:

- Imperfect Information

- Presence of Positive consumption externalities

- Poor decision making - takes into account short-run costs but ignores long-run benefits

However, evaluating whether a good is classed as a merit or demerit good depends on the subjective value of the individual i.e. not all individuals value a cultural trip to a museum.

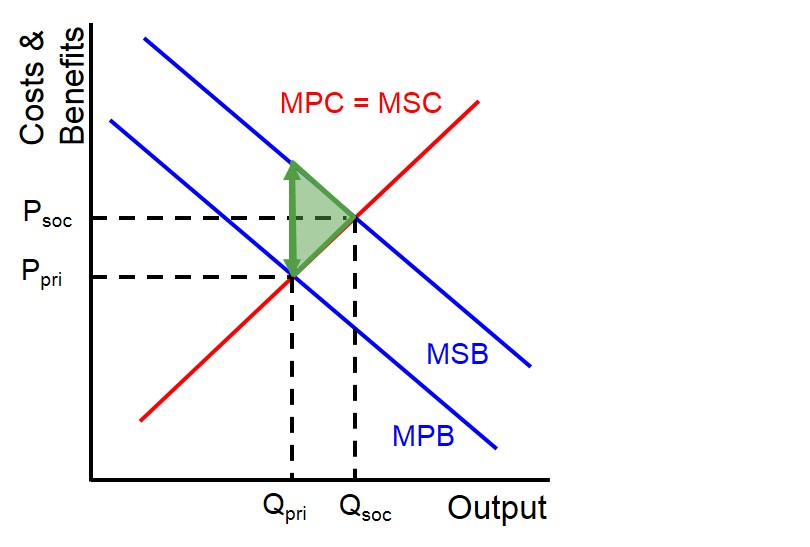

Below is a diagram to show an example of a market for a merit good:

The degree of market failure in this market is highlighted by the dead weight loss triangle - this measures the external benefit that the market has not exploited because of the under consumption.

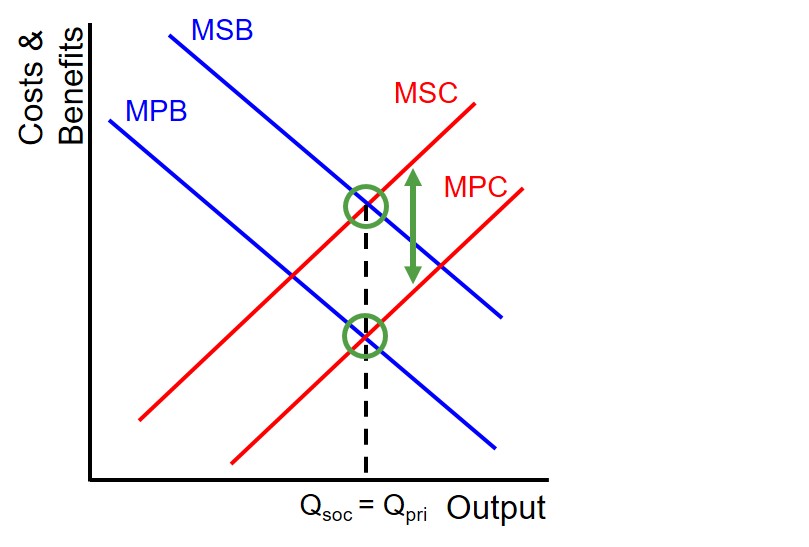

Therefore to eliminate this market failure and to provide the market with the socially optimum level of output, the government must intervene to correct the difference between the MPB and MSB curves. Governments will try to increase the supply of the good, which in turn will increase the consumption of the good. The level of government intervention will depend crucially on the size of the external benefit foregone as a result of the market failure. For extremely important merit goods such as health care and education, the government is likely to introduce subsidies to ensure that these types of goods are free at the point of consumption. The impact of the subsidy will be to reduce the costs of production for the market providers of the good and this will shift the MPC curve outwards (The size of the MPC curve shift will depend on the value of the subsidy imposed on the market). If the subsidy is applied correctly to the market this means the socially optimal level of output will be produced and the market failure will be eliminated. This is shown in the diagram below:

But, just because the government intervenes in the market, this does not guarantee that the market failure will be eliminated. Potentially intervention by the government could worsen the market failure and this creates government failure. Also the success of applying the subsidy on the market depends on the ability to calculate the value of the positive consumption externality for this good and this is very difficult to quantitatively calculate for governments.

The rule of thumb is that as the size of the dead weight loss triangle increases, the level of government intervention will increase as governments will be more confident of improving the current market outcome.

It is important to not assume that all merit goods are public goods despite the level of government provision in these types of markets. This is because many merit goods have a finite supply and as a result all these goods can be provided for by the private sector at a price. For instance, health care in most countries is charged for.