Policies that manipulate the money supply and interest rates and regulate the activities of banks to achieve monetary objectives such as an inflation rate target and availability of liquidity (loans). In recent times, governments around the world have transferred responsibility for monetary policy to central banks.

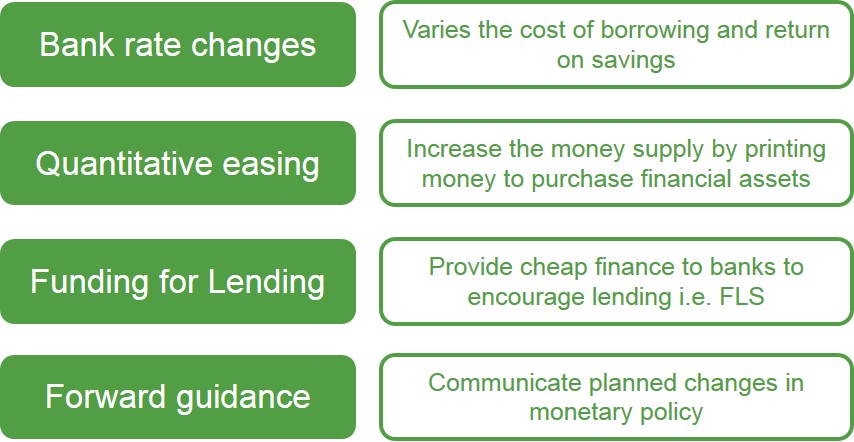

Below is a list of the main forms of monetary policy that the Monetary Policy Committee (MPC) decide to use to control inflation and meet the Consumer price index (CPI) inflation target of 2%.

The most common form of monetary policy is for the central bank to make changes to the bank rate (interest rates) and this in itself can come in two different forms depending on the state of the economy:

- Tight Monetary Policy (Expansionary)

- Loose Monetary Policy (Contractionary)

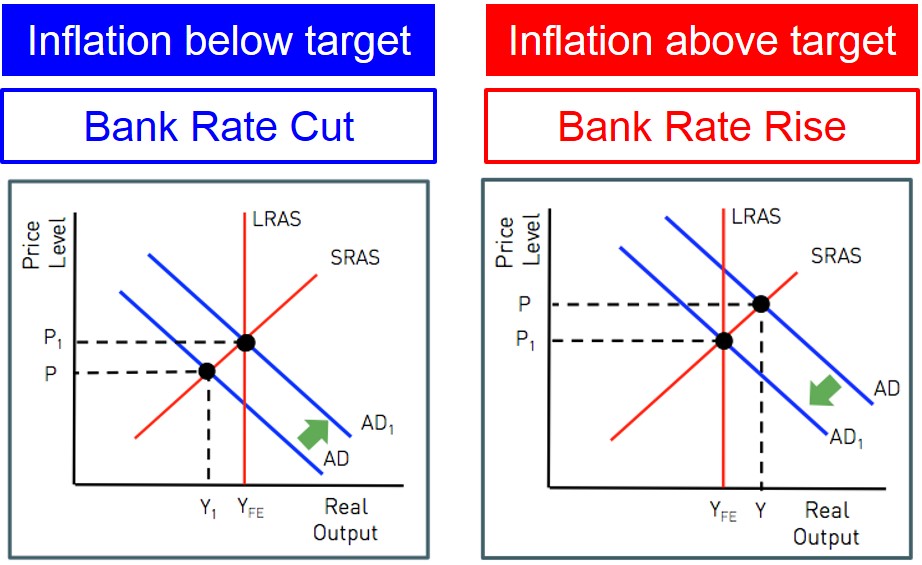

Below highlights the effects on the economy of these types of policies:

In the case where inflation is below target, the bank rate needs to be cut to encourage economic activity (i.e. consumption and investment). This creates more demand and feeds into the AD curve outwardly shifting to AD1. As a result the negative output gap has been removed and inflation has been restored to stable level, in and around the central bank's CPI inflation target.

In the case where inflation is above target, the bank rate needs to be increased in order to discourage economy activity, in order to prevent the economy from overheating. This reduces demand and feeds into the AD curve inwardly shifting to AD1. As a result, the positive output gap has been removed and inflationary pressures have been controlled to a stable level.

However, using monetary policies to control inflation is not an exact science and there will be lots of external factors that impact the effectiveness of these types of policies.

The main evaluative point to make regarding this, is that the ability of the central bank to influence economic activity and the inflation rate all depends on the current level of interest rates. For instance, if a central bank wishes to stimulate AD to lift economic growth and inflation, the ability to do so will be constrained if interest rates are already close to zero. When interest rates are at or close to zero this is called the 'zero lower bound' and it means that the ability of the central bank to stimulate the economy through the conventional transmission mechanism is reduced as predominantly central banks avoid interest rates becoming negative - as this encourages agents to hold cash instead of placing in a bank account. From the banks perspective, negative rates encourage them to keep hold of their cash as by lending they have to pay the interest to the borrowers. Therefore, conventional monetary policy is only effective if interest rates are not already near zero.

For instance, the impact of a rate change on economic activity will depend on the level of confidence in the economy at a particular point in time. If confidence in the economy is high, then a rate increase to curb inflation will not be as effective due to consumers not deterred by the higher borrowing costs such is the level of confidence they have.

Another point to evaluate is the presence of significant time lags when dealing with monetary policies i.e. according to the transmission mechanism, it takes two years for interest rate changes to feed into the inflation rate and this makes implementing monetary policies more problematic as policymakers (MPC) need to predict the inflation rate two years in advance. Of course, inflation forecasts are often inaccurate as there are many economic shocks which forecasts cannot account for which eventually affect the actual inflation rate realised in two years time. This inaccuracy in forecasts often leaves policymakers only making gradual changes to the bank rate rather than significant changes - so they can gauge the initial reaction and level of confidence in the economy. If the policy is successful then it paves the way for further rate changes.