Rules and laws enforced by governments that influence the supply and consumption of specific goods and services e.g motor insurance is compulsory, annual MOT test enforces a minimum safety standard on motor vehicles, no smoking in places of employment.

Regulation is predominantly used to control externalities present in a market. That is because the presence of these externalities leads to social welfare being lower than what could be achieved, due to the presence of a dead weight loss triangle e.g. a negative production externality. Therefore, regulation allows governments to remedy perceived flaws in the economic system by helping combat the private incentives of firms.

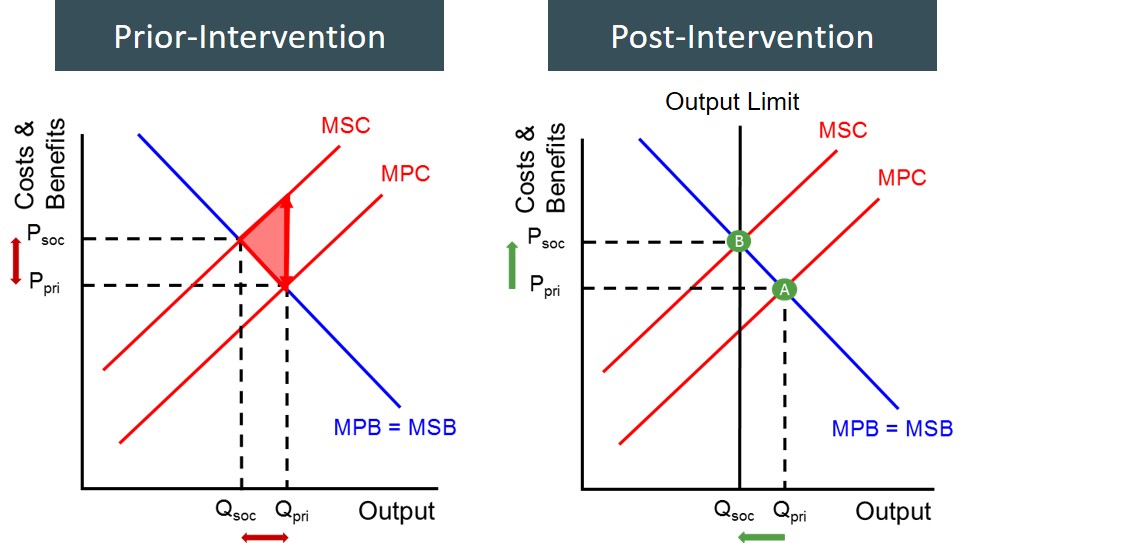

Externalities can be reduced through a number of different policy approaches but regulation reduces/removes an externality differently compared to indirect taxation and subsidies. This is because regulation does not affect the marginal private cost curve's position relative to the marginal social cost curve (like an indirect tax or subsidy would do). Instead it places a fixed limit on the output of the good in the market. This means that if the regulations are respected by operating firms in the market, then the market output will not exceed that point. Therefore, it is the government's role to identify where the point at which social welfare is maximised (social optimum) and then set the degree and level of regulation based on that point. If they can correctly identify this point the regulation will ensure the social optimum is met, welfare is maximised and the market failure no longer persists.

The desired outcome of regulation in a market where a negative production externality is produced is shown below.

As a result of a negative production externality being produced, output needs to be reduced via regulation. The output limit is set at Qsoc to maximise social welfare.

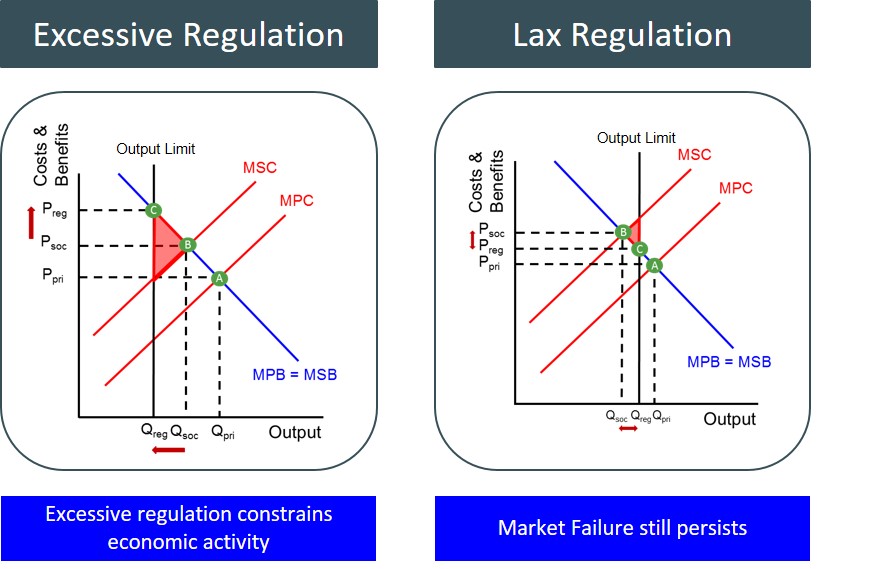

However, the ability of the government to be able to identify this social optimum point (B) in reality is much more complex and challenging. Therefore, the government has to estimate this point and this can lead to the wrong level of regulation being imposed on the market. They may place too much regulation on the market worsening the outcome prior to intervention and move the market from one extreme to another i.e. the good goes from being over-provided to under-provided. In this case the red tape from the regulation has become excessive and places unnecessary restrictions on firms. This raises their costs, reduces their margins and reduces their overall level of competitiveness. This backs up the free marketeer argument regarding regulation.

However, it could well be that the level of regulation is too lax and this means market failure still persists even post-intervention. As a result social welfare may improve but has not been maximised.

These two cases are shown below in a diagram:

One of the main issues with regulation, is how the government can effectively enforce this type of regulation, as effectively all that is passed is a law i.e. there is no guarantee that firms will abide by this new law. As a result, firms may sense their chance to withhold information from the government in order to avoid the financial punishments of failing to abide by the new regulations. Also, regulation can drive some firms to act collusively as they try to escape the excessive and out-dated red tape put on their costs.

Also, the effectiveness of regulation will all depend on the ability of the firms in question to absorb the new laws. For instance, when considering regulation against pollution, the ability of firms to combat pollution creating activities must be taken into account. This is because not all firms can reduce pollution at the same cost as other firms because of the level of technology some firms have available to them. This makes it more challenging to setting the right level of regulation across all firms.

However, on a positive note regulation is quick, simple and easy to enforce when compared to other methods of government intervention and this allows the regulation to adapt to the changing landscape of the market when required, unlike taxes which can be a very complex policy to change in the economy.