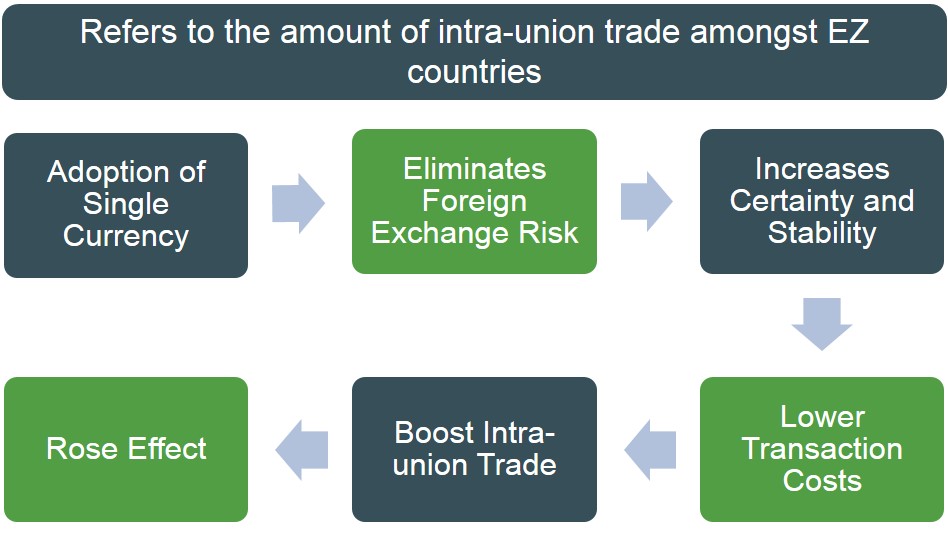

Is the perceived increase in intra-union trade that should occur when a country decides to become part of a single currency.

Below is the logical chain of reasoning for how the rose effect comes about for a country. The adoption of a single currency removes any instability by eliminating foreign exchange risk and therefore this encourages countries to invest and trade with each other, eventually making the net benefits for that country of joining a single currency greater. It was argued by Andrew Rose (the founder of this theory) that this effect could be as large as a 40% of GDP increase in trade.

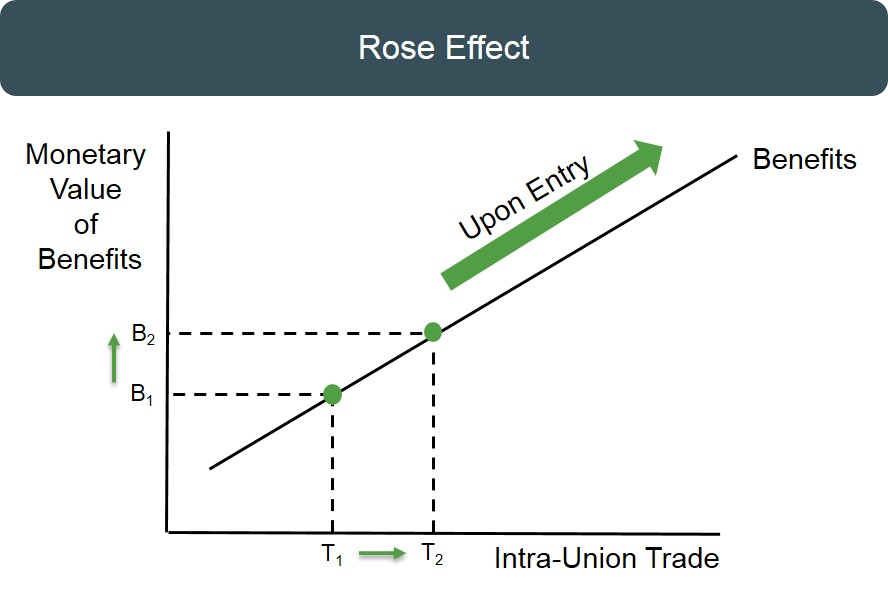

Below is a diagram to show the net benefits increase that comes with higher intra-union trade.