A financial document that measures a country’s economic activities with all other countries over a period of time. These documents are made up of two different accounts: Current Account and Financial Account.

The current account is a main measure of trade of goods and services between other countries and therefore is a sign of the relative competitiveness of a country to the rest of the world. The financial account is a measure of financial flows between countries such as trades of financial assets. These documents must balance and therefore if a country is running a large deficit on one of the accounts then they must have a similarly large surplus on the other account to make the balance of payments 'balance'.

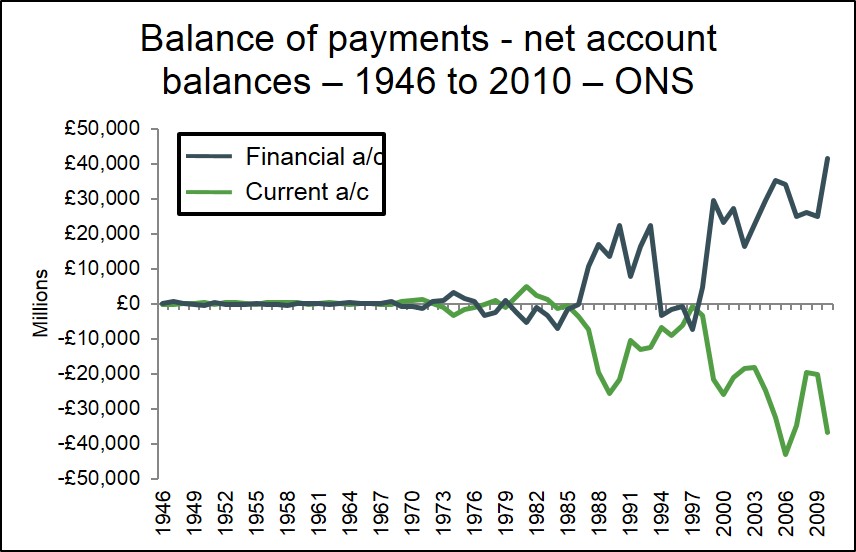

The diagram below shows the UK's balance of payments position from the years 1946-2010. The most striking image from this diagram is that the UK have been continuing to finance a growing current account deficit with a growing financial account surplus i.e. selling financial assets to borrow money to finance the deficit on goods and services to live beyond ther means.