Is a macroeconomic term used to describe the problem that central banks face in trying to stimulate the economy through a conventional monetary policy when interest rates are already at or close to zero.

The central bank of a country is responsible for keeping the inflation rate within their target (e.g. UK Consumer Price Index Target = 2%) to ensure macroeconomic and financial stability across the economy. The conventional way the central bank can do this is through changes in interest rates (bank rate). This is because interest rates affect the return economic agents get on their savings and the interest that banks can charge when lending out cash to borrowers.

For instance, if the central bank wishes to use interest rates to stimulate the economy, in order for the economy to move back to the full employment level, then interest rates are cut. Assuming ceteris paribus, this creates less incentive for consumers to save and in the process encourages consumption. The increase in consumption fuels higher demand for goods and services and real output rises. It also helps increase real output through an investment channel - firms now find it cheaper to borrow when acquiring loans to finance productive and profitable investment projects. The increase in investment increases demand and real output even further.

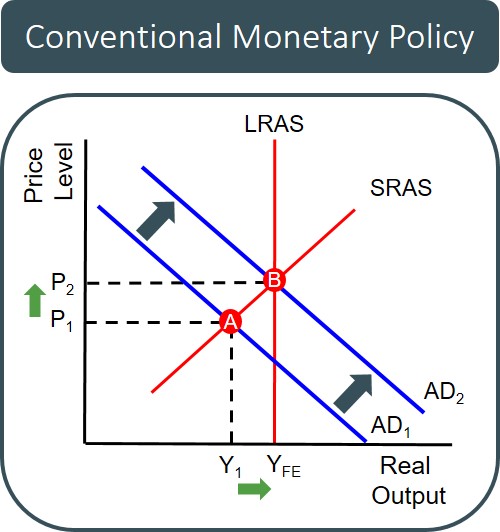

The combination of channels fuels higher real output which introduces inflationary pressures into the economy. This should theoretically move the economy back to the full employment level at point B, as shown below:

This is an example of the type of monetary policy that was used in the aftermath of the 2008 financial crisis in the UK, when interest rates dramatically dropped to 0.5% in 2009. This resulted in a upturn in UK economic growth. However, this may have created the perfect economic conditions for economic growth to recover to some degree, but has put the Bank of England in a difficult position regarding the conduct of future monetary policies.

This is because when interest rates drop to in and around 0%, the ability of the central bank to stimulate the economy through a conventional monetary policy becomes restricted. This is because there is not much margin for interest rates to fall any further before becoming negative, which is often a policy decision that central banks aim to stay away from. This is because negative interest rates:

- Encourages consumers to hold onto cash balances - consumers now have to pay the bank that they are depositing their funds with. This means from their perspective, they are essentially paying commercial banks a sum to provide the banks with funds that they can make profit out of. Consumers will have the incentive to hold onto cash at no cost.

- Encourages banks to keep hold of cash reserves - under the negative rates, banks now have to effectively pay the lenders when they lend a fixed amount of money to them. They will have a incentive to hold onto cash reserves as no cost associated with this.

These two effects combined means that once interest rates approach zero, the central bank can no longer use the base rate to control the economy in the conventional way. This is known as the 'Zero Lower Bound Problem'.

This is a key evaluation point to mention if tackling an exam question on the impact of monetary policies on the macroeconomic performance of the economy, particularly if you are making reference to the effectiveness of such policies i.e. if interest are close to zero the central bank may have to turn to alternative monetary policy instruments such as Quantitative Easing.