The total supply of goods and services at any given price level over a given period of time.

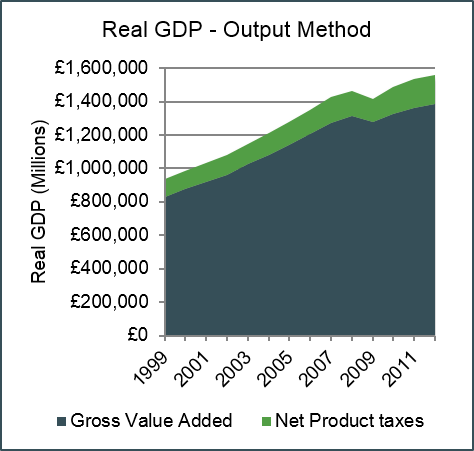

This is usually measured using GDP using the output method. Value added is based on the value of final output in the economy less the cost of inputs used up in the production process. Final output represents the finished goods, excluding intermediate goods, which are inputs used in the production of finished goods or services.

If the final product is a car, the intermediate goods/inputs will be goods such as the car components, electricity and advertising purchased to produce the car. As the value of the final good (the car’s price) reflects both the value of its inputs (the tyres) and the engineering expertise of the manufacturer, adding the final output of the tyre manufacturer to final output of the car manufacturer together would overestimate GDP.

To avoid this double counting, the value added at each stage of production is calculated. These items are then aggregated to produce a figure for each production process and then the whole economy so that the figure reflects the gross value added (GVA) by all productive processes. This measure is referred to as GDP at market prices.

As the value of the final output includes the net effect of product taxes (product taxes less any subsidies provided) this value is calculated separately. If the net effect of product taxes is removed from the estimate of GDP it is referred to as GDP at basic cost.