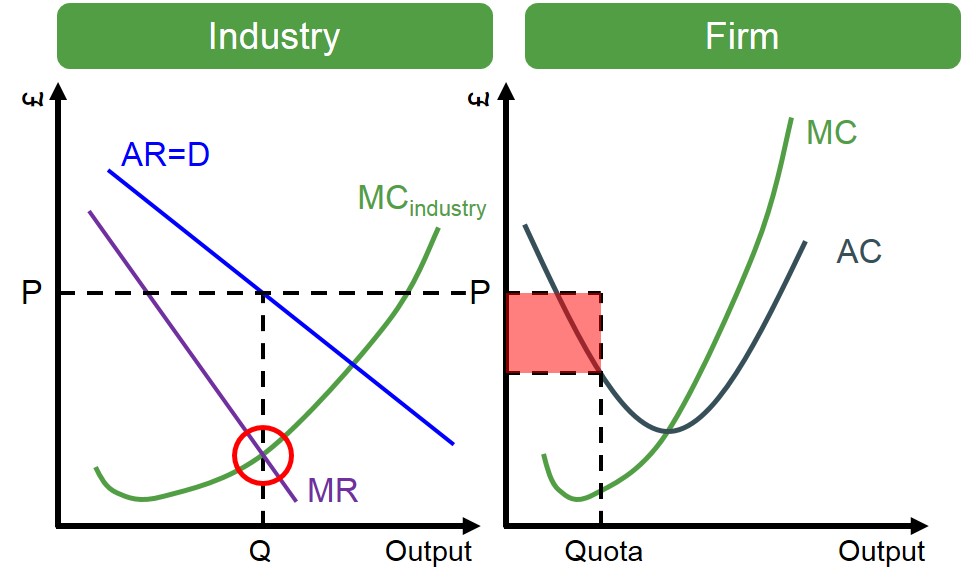

These are price fixing agreements where individual firms are given production quotas for the given market.

Below is a diagram showing how a cartel gets formed in an industry and how it affects each of the individual firms involved. If each of the firms involved charge a price of P at their given quota they will make a high level of supernormal profits (shown by the red box) whilst more importantly maximising industry profits (MR=MC). The idea is that if firms stick to this production quota, profits across the industry will be maximised.

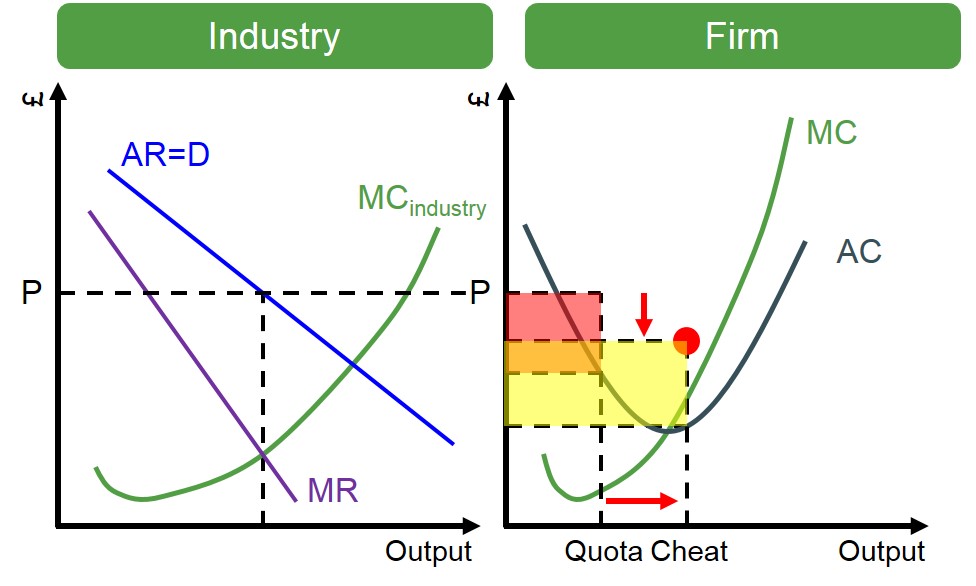

But the issue with a cartel is that firms have an incentive to 'cheat' - by producing more than their subscribed quota to ensure they can increase their level of abnormal profits. The diagram below shows how a cheating firm can charge at a lesser price and produce above their quantity to increase individual profits (shaded orange box).