Changes in taxation or expenditure that are designed to inject demand into the economy.

Below are a set of graphs to show the impact of the government running an expansionary fiscal policy on the economy in an AD/AS framework. This is done through cutting taxes, increasing government expenditure or possibly both from the classical viewpoint. Regardless of whether the economy has spare capacity or not he impact of the policy is to shift the aggregate demand curve outwards to AD2.

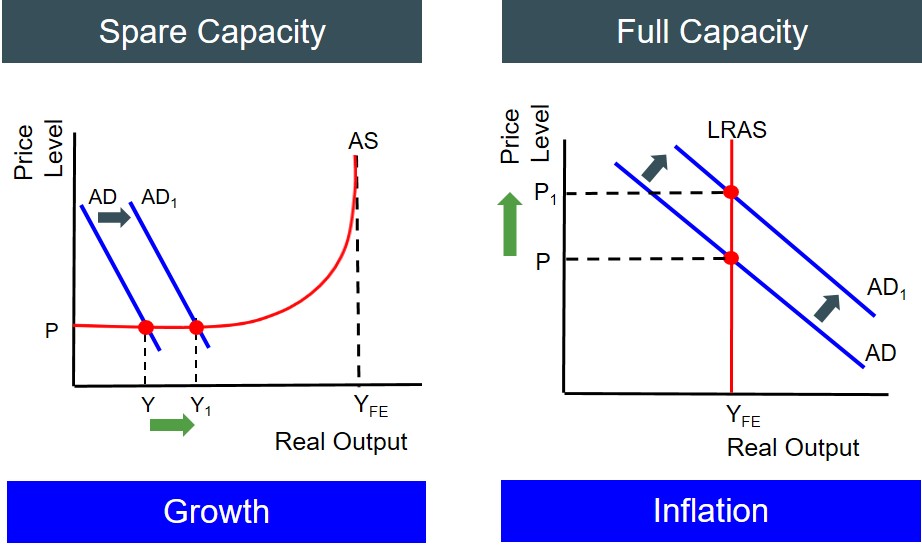

However, what is important when evaluating the effects of an expansionary fiscal policy is to take into account the amount of spare capacity in the economy at the time. The greater the degree of spare capacity, the more effective and the less inflationary the policy is. In the case below, when an economy has significant spare capacity, an expansionary fiscal policy shifts the aggregate demand curve outwards , as a result of spare resources in the economy being available this creates little pressure for the inflation rate to accelerate. Therefore, the final impact on the economy is to achieve short-run growth - whether that is sustained in the long-run depends on what sectors of the economy the fiscal policy targeted. This is the Keynesian viewpoint of demand side fiscal policies such as this one - creates growth without inflationary pressures due to the presence of spare capacity in the economy.

However, an alternative viewpoint could be that if the economy is at full capacity then a policy that aims to inject economic activity and demand into the economy could cause the economy to overheat and create significant inflationary pressures in the process, without the benefits of higher economic growth. So effectively in the long-run we are just moving up the LRAS curve. This tends to be the classical viewpoint on these types of policies - unless there is an accompanying LRAS curve shift then effectively the policy just becomes inflationary.