Scenarios in which economic outcomes are distorted because economic agents (principal) rely on the services of and are influenced by an agent that may have different objectives/incentives.

The most common example of this is the differing objectives between shareholders and managers. Shareholders wish to maximise profits and managers have internal goals relating to self-interest, but due to asymmetrical information it is difficult for shareholders to detect this.

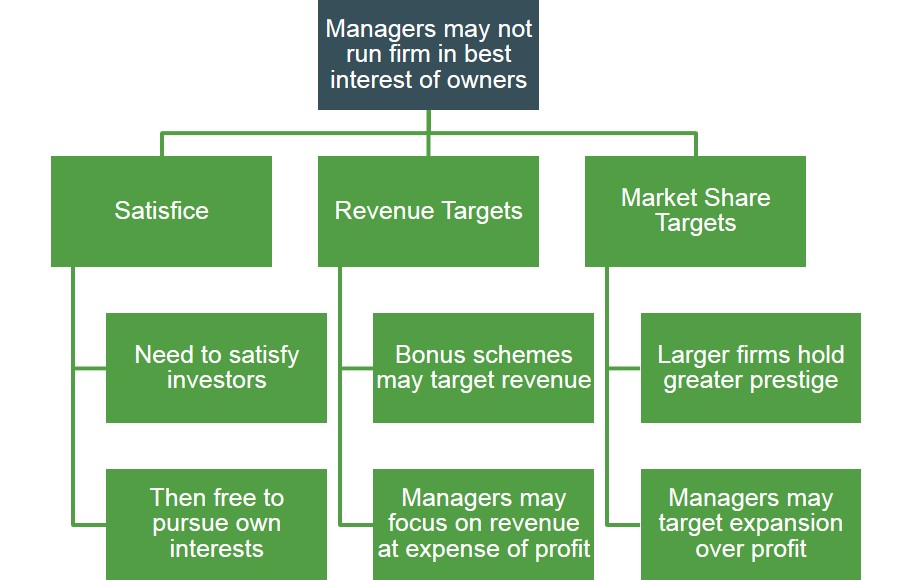

Below is a breakdown of this type of problem relating to shareholders and managers. In this case the manager has three main objectives to achieve alongside maximising return for shareholders. For instance it may be that managers try to help the firm acquire as much market share as possible in order to make the firm grow and expand to meet those customers. This is becaue firms that have exponentially grown are often the firms that are most impressive from a manager's performance persepctive and therefore it will put the manager's value higher from not just within the company but from external companies. Therefore they may decide to reinvest majority of the profits the company makes to help fuel expansion rather than paying higher dividends to shareholders.